Brick by Brick

about project

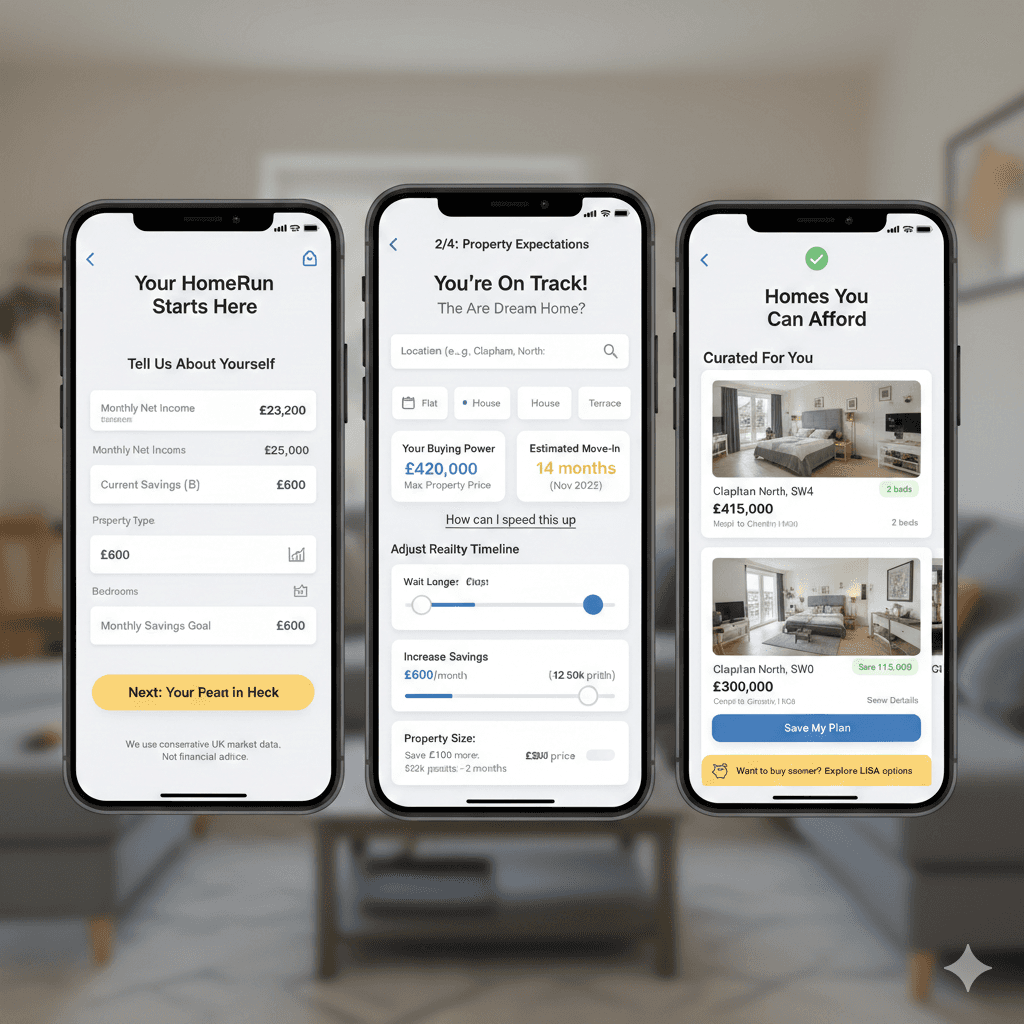

Problem Statement

First-time buyers in the UK waste months or years browsing properties they cannot realistically afford, driven by unclear affordability rules, opaque timelines, and lack of feedback on “how far away” they actually are from buying. This leads to anxiety, poor financial decisions, and disengagement from the buying process for our next generation of homebuyers.

Target User

Primary:

UK first-time buyers, age 25–35, salaried with savings, unsure if or when they can buy.

Secondary (later phase):

Estate agents seeking verified, serious buyers and reduced admin overhead.

Product Vision

Turn home buying from fantasy scrolling into a clear, time-bound plan.

Users should leave knowing:

If they can buy

When they can buy

What they can buy

Core Pain Point

“I want to buy a home but I have no idea where to start, I need either a guide or a reality check.”

Key User Journey (MVP)

User inputs income, savings, expenses, location, property expectations

System calculates realistic borrowing power and deposit trajectory

User receives maximum realistic purchase price

User is shown example properties they are actually on track for

User can choose to:

Swipe on the properties they want to book in a viewing for

Reject all properties

If all properties are rejected, user will be shown a clear gap analysis (what’s missing)

The ProblemThe System Advice (Gap Analysis)

Location Gap"Properties matching your criteria are $100k higher in this area. Try [Suburb B] for a 15% saving."

Savings Gap"To afford these properties, you need a $15k larger deposit. At your current rate, this will take 6 months."

Expectation Gap"You want 3 bedrooms, but your budget fits 2. Consider a fixer-upper or a flat."

MVP Features (Must-Have)

Affordability Calculator

Income (single/joint)

Current savings

Monthly savings rate

Credit assumptions (simple, conservative)

Location-based price data

Time-to-Buy Forecast

Months until target deposit

Sensitivity view: “If you save £X more, timeline shortens by Y months”

Reality Check Output

Plain-language summary (non-jargony)

Example:

“At your current savings rate, you are 18 months away from homes priced around £420k in Zone 3.”

Example Property Feed (Read-Only)

Not browse-all

Curated to affordability range only

Prevents fantasy scrolling

Explicit Non-Goals (MVP)

No agent matching

No swiping

No booking viewings

No mortgage applications

No financial advice certification (informational only)

Success Metrics (MVP)

≥70% of users complete the affordability flow

≥40% return within 7 days

≥25% adjust inputs to test scenarios (behavioural engagement)

Qualitative: users say “this was sobering but helpful”

Key Assumptions & Risks

Assumptions

Users prefer blunt clarity over false optimism

Seeing a timeline increases motivation rather than discouragement

Risks

Overly conservative calculations may demotivate users

Users may want “what they could buy” rather than “what they should buy”

Mitigation: framing language carefully, optional “optimistic vs conservative” toggle later.

Future Phases (Not MVP)

Phase 2

“Verified Buyer” profile

Shareable affordability summary

Opt-in lead sharing with estate agents

The "Micro-Feedback": If a user swipes left, ask why (Too small? Wrong area? Needs work?). This feeds the Gap Analysis.

Phase 3

Buyer–agent matching

Viewing slot booking

Transaction support ecosystem

Property vs Stocks personal calculator

Potential Monetization for the MVP

Since you are pre-qualifying users, your "leads" (the people who swipe right) are incredibly valuable to:

Mortgage Brokers (The user needs a loan).

Buyer's Agents (The user needs help finding the gap).

Savings Tools (The user needs to fill the deposit gap).